Britain's decision to leave the EU has led to a "dramaticdeterioration" in economic activity, not seen since theaftermathof the financial crisis.

英国脱欧已导致经济活动“急剧恶化”,其严重程度为金融危机余波以来之最。

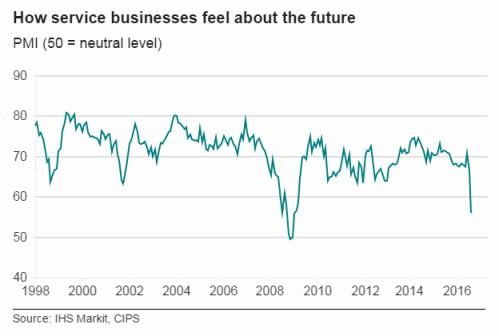

Data from IHS Markit's Purchasing Managers' Index, or PMI, shows a fall to 47.7 in July, the lowest level since April in 2009. A reading below 50 indicatescontraction.

研究机构IHS Markit数据显示,7月份英国采购经理人指数或PMI降至47.7,为2009年4月以来的最低水平。该指数降至50以下则意味着经济萎缩。

The report surveyed more than 650 services companies, from sectors including transport, business services, computing and restaurants. It asked them: "Is the level of business activity at your company higher, the same or lower than one month ago?" It also asked manufacturers whether production had gone up or down.

这份报告调查了650多家服务业公司,涉及到交通运输、商业服务、计算机和餐饮业。这些公司需回答“贵公司商业活动与一个月前相比较为活跃,保持不变,抑或有所减弱?”调查中还询问了制造商的生产水平是上升了还是下降了。

Recordslump

创纪录的下跌

Chris Williamson, chief economist at IHS Markit, said thedownturnhad been "most commonlyattributedin one way or another to 'Brexit'." "The only other times we have seen this index fall to these low levels, was the global financial crisis in 2008/9, the bursting of the dot com bubble, and the 1998 Asian financial crisis," Mr Williamson told theBBC.

IHS Markit首席经济学家克里斯·威廉姆斯称指数下降“很明显在这方面或那方面受到了英国脱欧的影响”。威廉姆斯先生还对BBC说:“指数下降到如此低的水平,我们只见过为数不多的几次:2008年9月的全球金融危机、互联网泡沫爆炸、1998年的亚洲金融危机。”

The difference this time is that it is entirely home-grown, which suggest the impact could begreater on the UK economy than before.

本次指数下降的不同之处在于它完全是内生性的,也就意味着它会对英国经济造成比以往更大的影响。

Heading forrecession

走向衰退

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the figures provided the "first major evidence that the UK is entering a sharp downturn". Neil Wilson, markets analyst at ETX Capital, said he thought the UK was "heading for a recession again", and that the data would almost certainlypromptthe Bank of England to roll out furtherstimulus.

潘西恩宏观经济咨询公司首席经济学家塞缪尔·托姆斯称这些数据“首次印证了英国经济正急剧下滑”。ETX Capital的市场分析师尼尔·威尔逊说,他认为英国“正再次走向衰退”,而且这些数据几乎一定会促使英格兰银行展开进一步的经济刺激计划。

The pound has fallen in response to the publication of the data.

数据公布后,英镑也随之下跌。

The UK's newchancellor, Philip Hammond, urged caution. "Let's be clear, the PMI data is a measure ofsentiment, it's not a measure of any hard activity in the economy. What it tells us is businesses confidence has beendented, they're not sure, they're in a period of uncertainty now." Earlier on Friday, Mr Hammond said that he might "reset" Britain's fiscal policy.

英国新任财政大臣菲利普·哈蒙德敦促各方警惕。“我们要清楚,PMI指数只能测量人们的情绪,却不能测量任何实体经济活动。它只能告诉我们商业信心受挫了,他们无法确定,他们正处于一种不确定的时期。”早在周五,哈蒙德先生就说他可能“重启”英国的财政政策。

No surprise

意料之中

While IHS Markit's reading on the UK economy was worse than most analysts expected, itsverdicton the wider eurozone economy was morecheery.

尽管IHS Markit的英国经济数据低于大多数分析师的期待,它对更广泛的欧元区经济状况判断却较为乐观。

Europe Economics' Andrew Lilico, who argued during thereferendumcampaign that leaving the EU would be beneficial for the UK in the long term, told theBBCthe PMI data was "no surprise", and that it "doesn't tell us much about what Brexit's longer term impact will be".

《欧洲经济学》的安德鲁·利里克曾在公投期间声称离开欧盟会为英国带来长期效益,他对BBC说PMI数据在“意料之中”,它“并不能告诉我们英国脱欧会带来怎样的长期影响”。

Mr Lilico said he always expected a short-term reaction, and those who voted to leave, "expected a short-termslowdowntoo".

利里克先生说他早就预料到会有短期的反应,而且那些投票脱欧的人“也都预料到会带来短期的经济放缓”。